How to Lock or Freeze Your Credit Reports From Equifax, Transunion, and Experian

With the number of data breaches that have happened, it’s almost a given that your personal data is compromised. Experts recommend locking or freezing your credit report as one way to help prevent identity theft. Happily, the process for locking and freezing has become a lot simpler later. Here’s how to do it for the three major credit reporting agencies.

Lock vs. Freeze

Credit locks and freezes both prevent agencies from accessing your credit report. This prevents hackers from opening new credit cards, loans, etc. in your name. Credit locks may have a fee though.

Credit freezes do the same things, but are regulated by the government, are always free, and guarantee certain legal rights.

These days, locks and freezes are almost the same. They achieve the same goal. My recommendations are below.

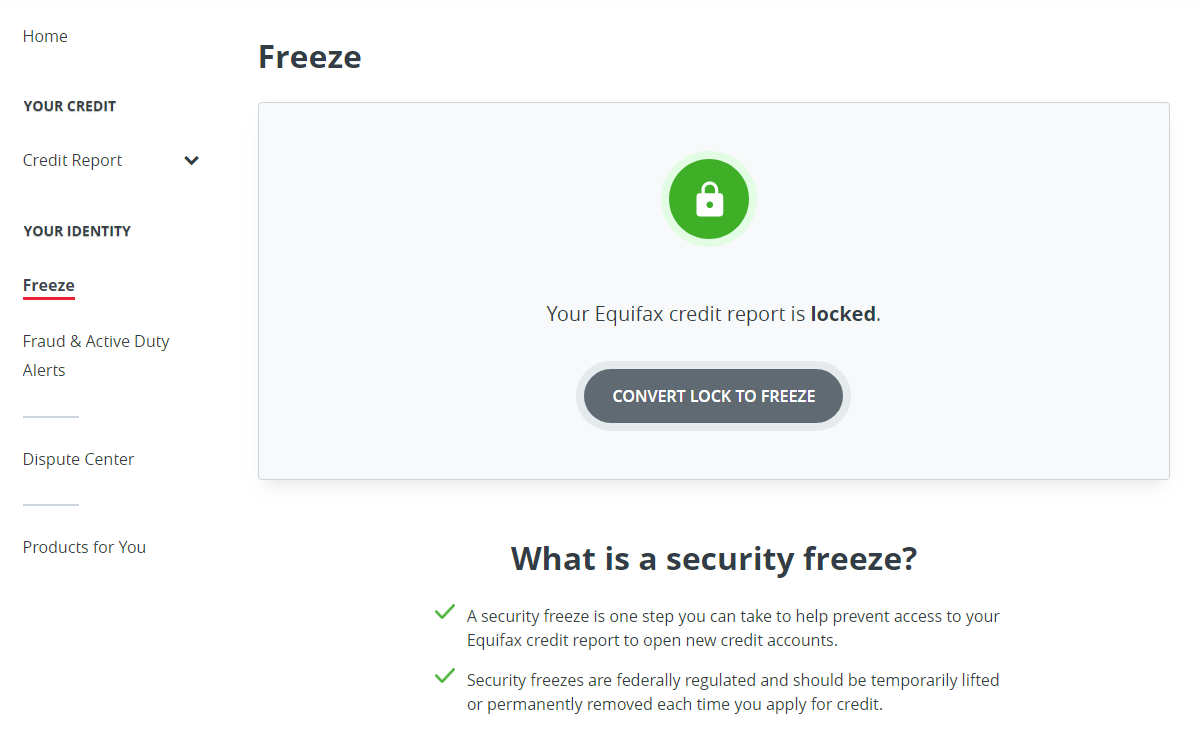

Equifax

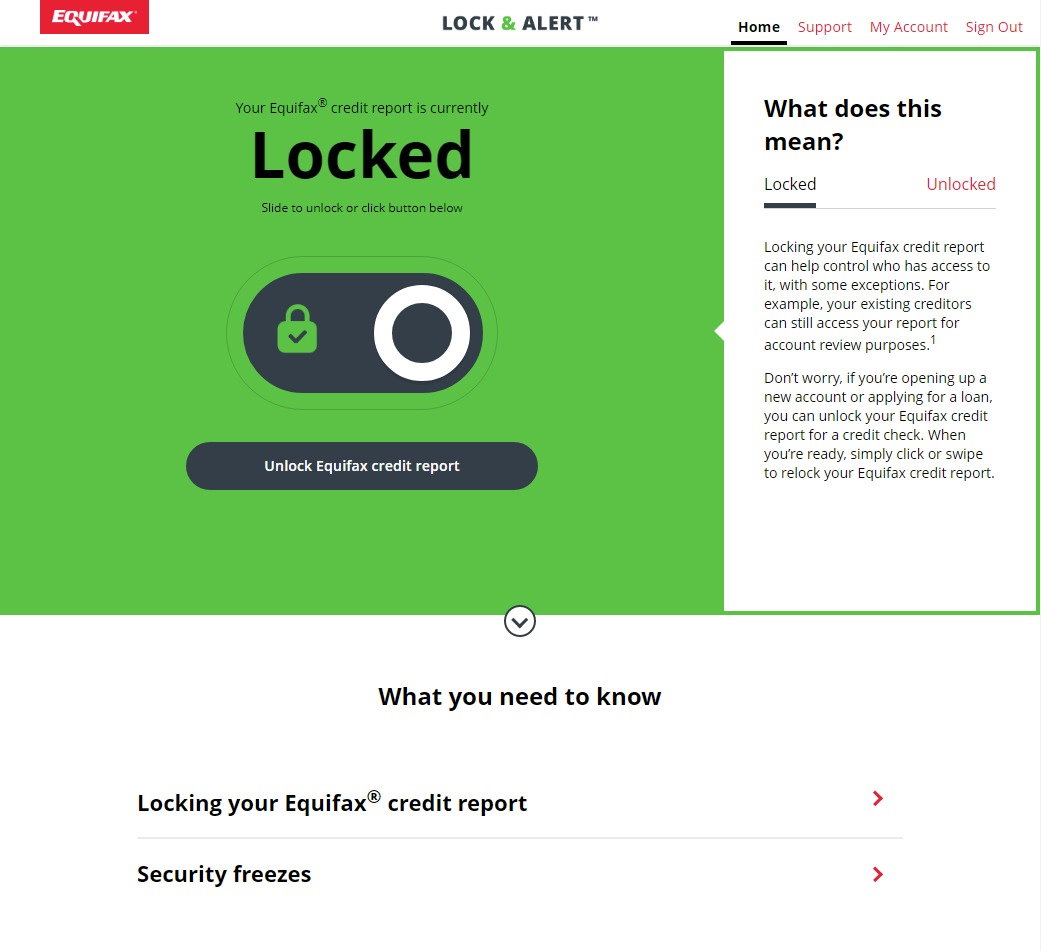

Perhaps due to a dose of humility after their disastrous data breach, Equifax now makes it very easy to lock or freeze your credit report, and both are free, through two separate websites.

Equifax handles credit locks through their free Lock & Alert service. You can sign up here:

https://lockandalert.equifax.com/

Pretty much all you can do there is lock and unlock your report. There are no credit reports, scores, etc. there. There is a mobile app which is a great idea in theory, but it is plagued with bad reviews. Some of these may be from folks confusing Equifax’s Lock & Alert service with their freeze service at my.equifax.com though.

To freeze your Equifax report, sign up here:

There, you can also get your credit report.

Which Should You Do?

The Lock & Alert website is very easy to use, and it sends you an email and text to confirm locks/unlocks. So, those are reasons in favor of locks. On the other hand, if you would like to someday get a credit report, you can only do that at my.equifax.com, so might want to do your freeze there as well and save yourself another login.

Neither of these sites offer two-factor authentication, so use a good password.

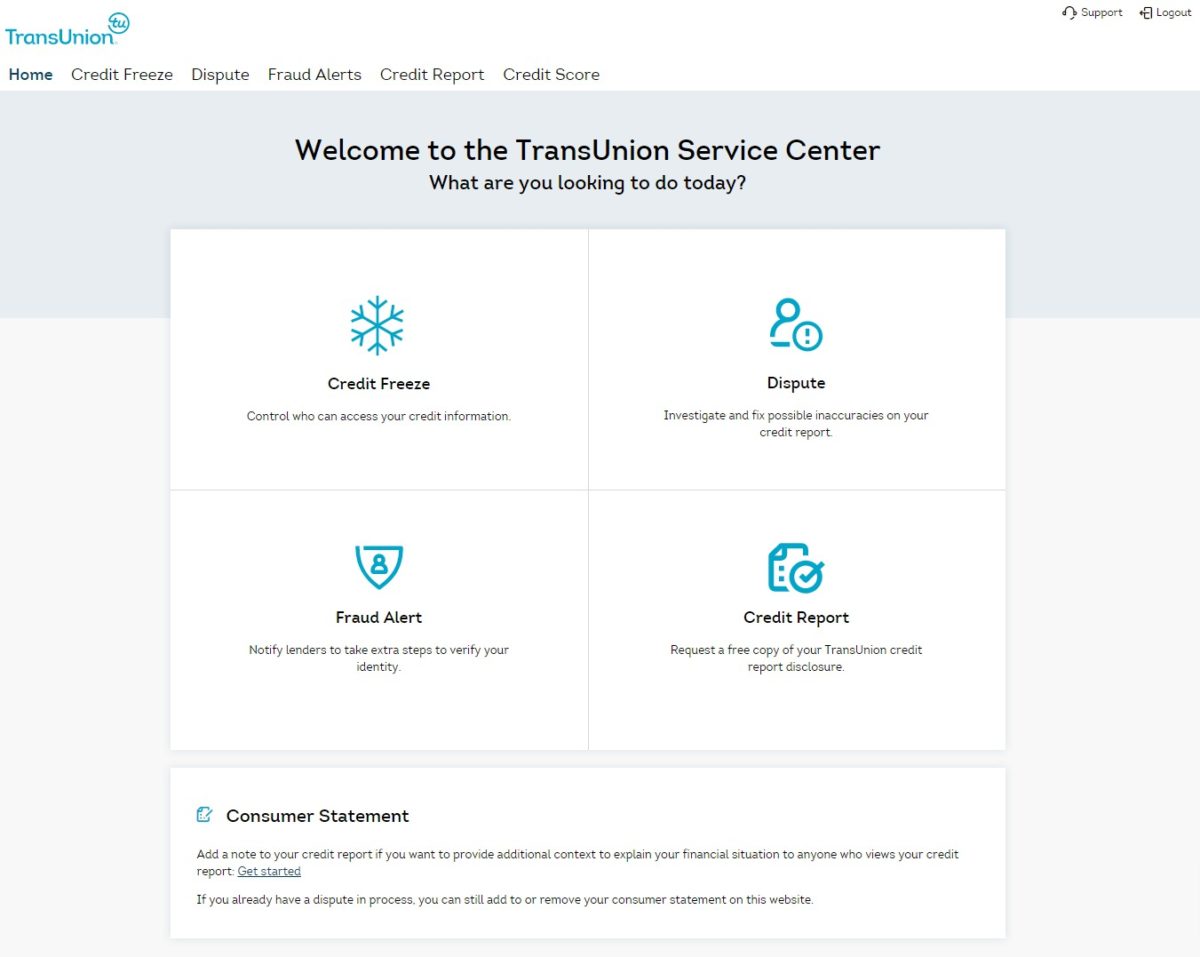

Transunion

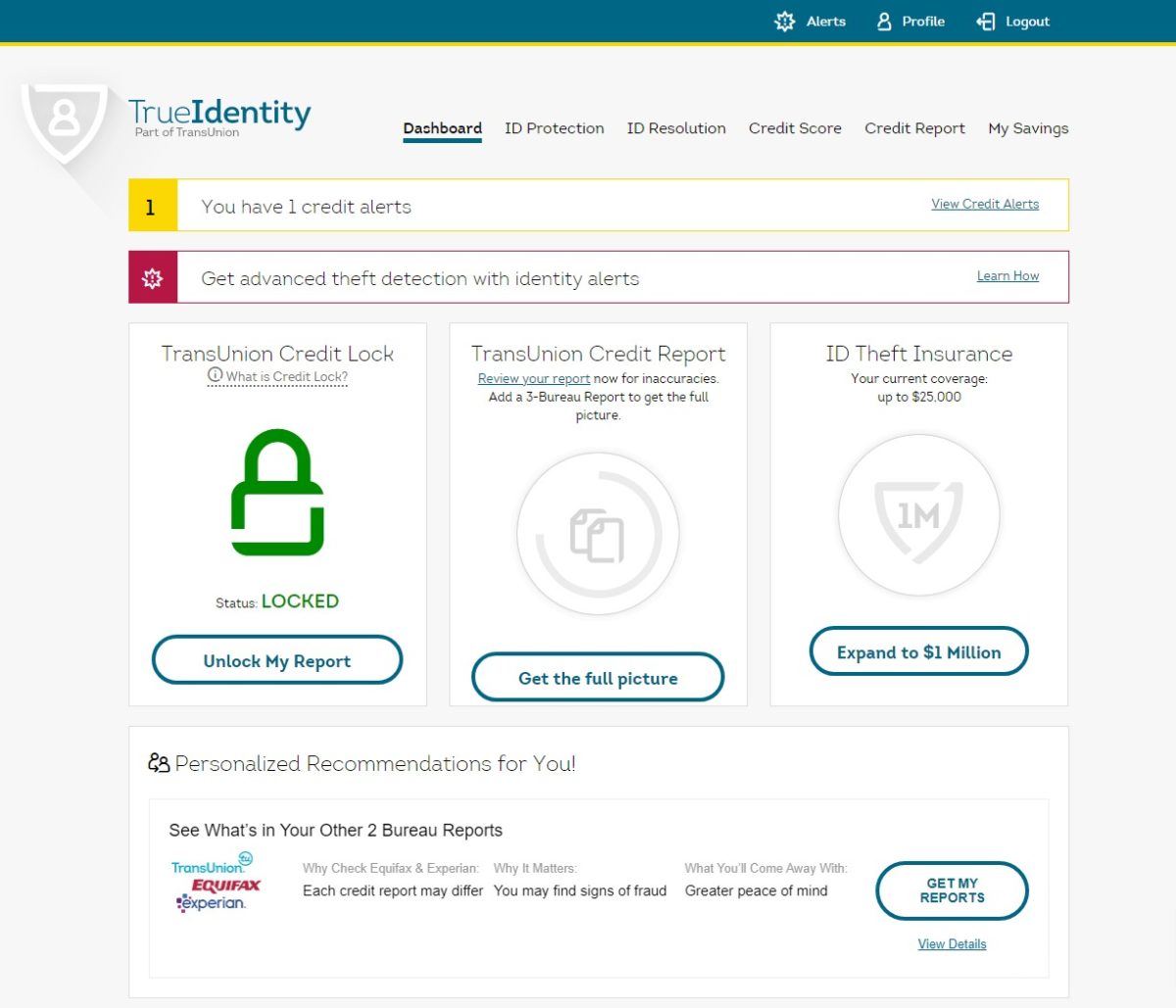

Transunion also offers locks and freezes, through two separate websites with two separate logins.

Locks used to be done through their free TrueIdentity credit monitoring service. They have now closed this service to new signups, although existing members can still use it for free.

https://membership.trueidentity.com/tucm/

If you don’t have an account, you’ll be given two paid choices. It’s unclear to me if there is a free way to do credit locks for new signups.

To do a free credit report freeze on Transunion, create an account here:

https://service.transunion.com/dss/login.page

Note that freezing requires creating an additional 6-digit pin.

Which Should You Do?

It looks like only freezes are free for Transunion (to new folks who sign up, at least). Therefore, I would go for that if you don’t already have an account on their free service, which is now grandfathered.

Experian: Freeze, Don’t Lock

Experian used to have a really convoluted set of separate sites for freezing, unfreezing, locking, etc. Fortunately, it’s much simpler now. Do a credit freeze at Experian for free here:

https://www.experian.com/freeze/center.html

Just be careful not to sign up for any paid plans. The website tries hard to upsell you on the landing page.

Locking requires a paid plan (called Experian CreditLock). But don’t do that. Just use the free freeze!

Experian also has a paid IDnotify service, which starts at $9.99 per month unless you got it for free (some companies offered free memberships to appease their data breach victims). In general, I don’t recommend paying for these services.

Which Should You Do?

With Experian, it’s a no-brainer. Do a freeze because it’s free and locks are not! There is no two-factor authentication on this site, so use a good password.

Some Tips

For best security, you should lock or freeze your report on all three credit agencies.

Be sure to keep your logins in a secure place so you can unlock or unfreeze your reports when you need to. I recommend using a password manager.

Rather than paying for credit monitoring services, I recommend these tips that you can do for free.

Remember…

If you apply for a credit card, loan, or many other types of financial services, your application will be rejected unless you unlock or unfreeze your report at the specific credit agency they are using.

I guarantee that you’ll forget that you locked your reports and that you’ll need to unlock them at some point. You’ll be at a department store, maybe about to purchase something expensive, when you try to apply for a new credit card (to get some amazing cashback deal), and your application will be rejected. So, you may want to make sure you’re able to unlock your reports using your phone.

I hope this was helpful to you! – Brian

Please Leave a Question or Comment

I try to answer each one! - Brian

You did not explain the difference between a freeze and a lock. Which one does what? What part does the government have to with a freeze and why? I would like to lock out anyone from getting my credit reports, is this possible?

Hi Michelle,

They both do the same thing. Either will lock out everyone else from getting your credit report. By law, freezes must be free. Locks are a similar service created by the bureaus for which they can charge, but they accomplish the same thing. The main differences are in the cost and in how you activate or de-activate them.

Brian