You’re Wasting Money If You’re Not Doing These Twelve Things

With rising inflation these days, it is prudent to think about ways to cut costs, especially recurring costs.

A monthly streaming TV subscription that costs “only” $25 per month translates into $300 per year. Over ten years, that’s $3000! Small monthly costs can add up to unexpectedly large sums when you think in terms of years.

Here are some of my tips to save money on these insidious recurring costs!

1. Switch To a Low-Cost Cell Phone Carrier

If you’re using one of the Big Three for your cell phone plan, you are leaving money on the table big time. Last year I switched from a $55/month plan on T-Mobile to a $17/month plan from a low-cost carrier on the exact same cell network. I’m using the same phone and I got even more data than I had before. I used to think low-cost carriers were scams, but they are legit, and they can save you serious money!

Check out my review of Mint Mobile or other ways to save on your cell phone bill. My annual savings is over $450. After a few years, I’ve saved over $1000!

Disclosure: Some of the links on this page are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. I test or research each product or service before endorsing. This site is not owned by any retailer or manufacturer. I own this site and the opinions expressed here are mine. As an Amazon Associate, I earn from qualifying purchases.

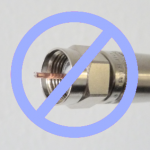

2. Ditch Cable TV and Expensive Streaming Services

I had cable for most of my life but got tired of the cable company raising my rates by 10% every year. So, I ditched cable TV and got a $30 antenna. Since I had a modern flat-screen TV, that’s all of the equipment I needed to get all of the networks plus PBS in HI-DEF!

For this to work, you need to live within 50 miles or so of the TV transmitters. If you live in a big city you should be fine. If you live in the country, best check before canceling cable. All of the details are at DisableMyCable.com.

Check out these ideas on how to lower the cost of streaming TV.

Sure, there are some shows that I used to watch that I miss. But, it wasn’t worth almost $1000 per year! As an added benefit, I’m watching less TV overall and doing more productive things instead. Annual savings can be $900 or more

3. Stop Using Storage for Pete’s Sake!

If you’re renting a storage unit for more than a few months, you’re doing it wrong. Think about the cost of storing the item vs. the cost of selling it and replacing it later. Often the storage cost will be more.

I have a friend who paid $400/month to store a huge expensive couch that someone gave him for “free”. He was lazy and left it in storage for 5 years, for a total cost of $24,000 for this “free” couch! I have so many friends with stuff in storage with money leaking out the door each month. Think of what you could do with that money, and whether the stuff you have in storage is worth it!

4. Agree to Stop Exchanging Gifts with Friends and Family

This might be a controversial one for some, but my wife and I love it. Maybe it’s time to agree with your friends and family to stop exchanging gifts that no one needs or really wants. Do you really need another candle? Why spend the time, money, and stress? A nice note or meal out together might be a better bet.

5. Use a High-Yield Savings Account

If you’re keeping a lot cash in a brick-and-mortar savings account, you could be losing out on much better savings and CD rates online. Check out Marcus.com for some of the best savings account and CD rates.

Disclosure: Some of the links on this page are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. I test or research each product or service before endorsing. This site is not owned by any retailer or manufacturer. I own this site and the opinions expressed here are mine. As an Amazon Associate, I earn from qualifying purchases.

6. Cut Your Energy Usage

The cost of energy continues to rise but you can make a big dent in your electric bill by reducing your usage of high-energy appliances.

Probably the biggest villain is your air conditioner. Keep it cooler inside by closing blinds when it’s sunny and opening windows when it’s cool, and add weather stripping to windows and doors. I hardly use my A/C while my neighbor keeps theirs on 24/7 because they don’t follow these simple tips.

Heating is another big energy consumer. On cold nights, we use a bed heater instead of heating the entire house.

Your dryer is another huge energy consumer. When weather allows, I hang-dry my clothes on my patio, cutting my already-low electric bill by another 10%. Yeah, it takes time, but it’s actually kind of relaxing and I enjoy it now!

Finally, switch to LED bulbs and turn off lights when you’re not using them. Put outdoor lights on timers rather than having them on 24 hours a day.

7. Review Your Insurance Periodically

The purpose of insurance is to protect you against catastrophic costs when an accident occurs. It is very important and necessary.

But, you shouldn’t rely on insurance to pay for things that you can afford. A lot of people have their car insurance deductibles set to only a few hundred dollars with the idea that insurance is supposed to pay for everything. That luxury will actually cost you money in the form of higher insurance rates.

If you are a good driver, you can save money by setting your deductible high to decrease your insurance rate. Check your rates. You can probably save a few hundred dollars in the long run, which would pay for any minor fender bender that you’d get. If you don’t get into an accident, you pocket the money, whereas if you paid insurance, you’d pay no matter what. Insurance companies need to make money off of any benefits they offer you.

Of course, if you are prone to frequent fender benders, it actually might be best for you to keep your deductible low. Anyway, it’s something to think about. While you’re at it, you can shop around for lower rates and potentially save hundreds annually.

I was stupid and stayed on COBRA health insurance after I left my job. I thought that was a benefit, but actually, private insurance or ACA insurance is much cheaper than COBRA. I could have saved $200 a month if I had known! Don’t make this mistake like I did.

There are other types of insurance that are usually bad deals, namely, insurance on electronics and cell phones. The insurance on my iPhone was $10/month or $120 per year! And, even with that “insurance”, I’d still have to pay a $120 fee on top of that to actually get a replacement! So, cell phone insurance is clearly a bad deal. I haven’t lost my iPhone yet after two years, so I’ve already saved $240!

8. Refinance Your Home/Car/Student Loans

We were able to save hundreds of dollars per month by refinancing our student loans at the lowest interest rate that I’ve found for student loans!

I also saved a bundle by refinancing my mortgage with my parents. This is not for everyone, but it was mutually beneficial for us!

9. Drive Less

Gas is expensive now, so you can save a lot by driving less if you have a gasoline engine car. Look into using public transportation or carpooling. If your destination is not too far, how about walking or biking? Why not get there and get your workout in at the same time?

We tend to only think about the cost of gas when we think about the cost of driving, but driving is actually even more expensive when you factor in the cost of maintenance and repairs. The IRS reimbursement rate for driving (which is an estimate of the real cost of driving) is 58.5 cents per mile in 2022. Wow!

If you lower your annual miles enough, you can not only lower maintenance and repair costs but also get a discount on your car insurance.

10. Buy Used or Borrow

Find your local Buy Nothing Facebook group, where you can ask to have or borrow items for free!

Check out Craigslist or eBay for stuff that is nearly as good as new but at a fraction of the cost! Borrow from friends instead of buying if you are only going to use it once.

11. Ditch Starbucks and Bottled Water

OK, by now we’ve all heard the debate about how making your own coffee may or may not be the first step to making you a millionaire. But, it really can save money. Dailyfinance.com calculated the annual savings of brewing at home vs. buying a cup a day from Starbucks to be $773.80!

Check out what Kevin O’Leary says about buying coffee every day.

While we’re talking about drinks, think about how much money you spend on bottled water. A water filter costs less per glass. Soda is just plain bad for you. Annual savings (one $2 cup per day) is $700.

12. Stop Smoking

Hopefully, you don’t smoke, but if you do, I don’t have to tell you how much it is costing you not only in terms of money, but more importantly your health and future medical bills. You can do the math. It’s a fortune in terms of your money and your health. Annual savings ($6/per pack, 1 pack per day): $2190

Bonus: Make Your Own Meals

I know some folks who eat out or get takeout for EVERY single meal. That’s fine if you don’t mind spending the money, but if you calculate the cost, it’s A LOT!

It takes time, but the savings are big if you can at least make your own lunch instead of buying it every day.

Conclusion

Well, I hope some of these ideas resonate with you. What tricks have you discovered? Please comment below! – Brian

Please Leave a Question or Comment

I try to answer each one! - Brian

Hi Brian,

Thank you for all the great info re cutting the cord!

Why is it that you and I and all of us do not have FCC licenses like the

“Big 3” networks, etc? They spread lies, create problems and discord, and yet are allowed to have a license.

Why don’t we all have these licenses? Serious question.

Thanks and all the best,

Gary

Coffee pods are expensive and the machines that use them are unreliable, in my experience. I have gone through many machines from the original brand to various clones and none lasted a year. So, what to do?

I bought a four cup drip coffeemaker and a quality, insulated, stainless travel mug that holds about 16oz. I fill the coffee pot reservoir with exactly the amount of water needed to fill the mug and the appropriate amount of ground coffee. The minute the coffee is done, I pour it into my (sometimes) preheated mug. Getting the coffee into the mug without letting it sit on the warming plate is the most important point and really the difference between a single serve machine and my dripper.

I get fresh coffee that stays warm long enough for me to drink it – no tossing out a partial cup because it’s cold. I can use all the same brands of coffee as the pods have and I don’t have to search for a mug that fits in the machine.

The main point is that I save a significant amount of money on pods and coffee makers.

Thank you for sharing Gail! Totally agree! – Brian